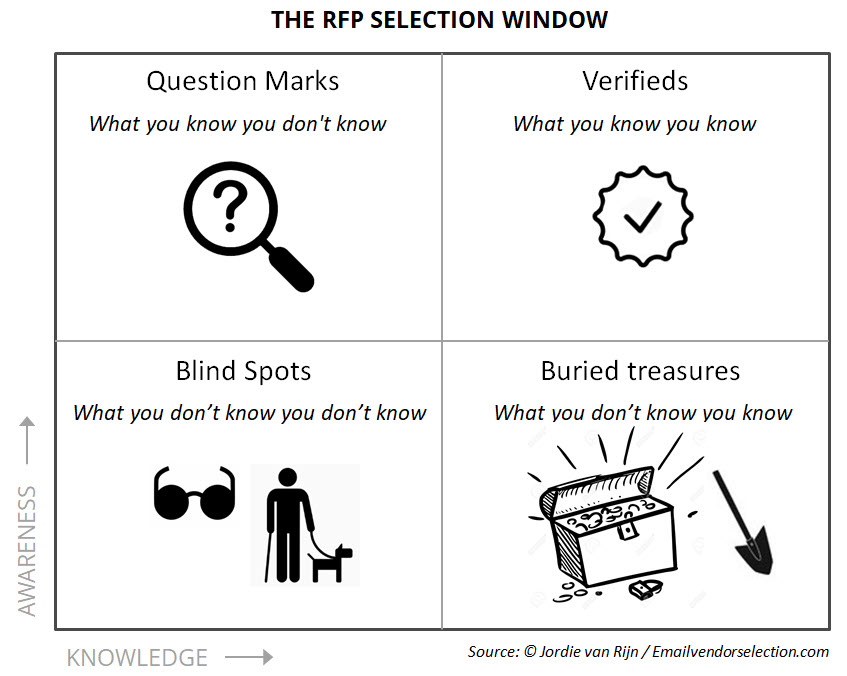

Selecting a new email marketing software is hard enough when you know what you should focus on. But without the right outside help, many RFPs will fail because of the blind spots email marketers are unaware they should be looking at.

When email marketers embark on an email software RFP, there are many things they already know. For example, they know the pain points with their existing Email Service Provider (ESP).

Common pain points with your current ESP can be:

- Missing functionality in the platform,

- Issues with the tool or services provided,

- and/or a feeling that you might be paying more than you should be paying.

In addition to the things email marketers know going into the RFP, there are also things they know they don’t know. These are the question marks.

Email marketers might have questions going in to an RFP like:

- Where is the market in terms of pricing?

- Can anyone solve the pain points I have?

- Who are the top email vendors today?

These are the questions that the RFP process itself is designed to answer.

Beware of your RFP Blind spots

But there is a third category that lurks within every ESP RFP, and it can lead to a breakdown in the RFP, or worse, a bad decision in the end. That category includes the things an email marketer isn’t aware of he/she doesn’t know. The Blind Spots. What typically falls under this category? Let’s take a closer look at several.

1. There are much bigger differences between ESPs than you have been led to believe (by everyone)

Most ESPs will tell you that they are the best ESP. And lots of analysts are in the business of telling you which is the best ESP. Neither of which tells the email marketer who might be the best ESP for his or her particular needs. You have to lift the curtain yourself to see that not every ESP is created equal. That’s because no ESP want to limit the opportunities they have to win business by admitting they can’t do something another vendor can do.

The downside is that often an email marketer will include ESPs in their RFP that really shouldn’t be included in the first place. They are solely there because they are “hot” in the marketplace.

I call it the “Flavor of the Week” syndrome.

Everyone’s time is wasted when an ESP that’s a very poor fit is included in an RFP, but even worse is when that ESP wins the RFP.

Including the wrong ESP, not knowing the right one

How could the wrong ESP possibly ever win? If a marketer doesn’t created a well-defined requirements document it’s actually easy to pick the wrong ESP. Or if they place too much emphasis on pricing above everything else.

The truth is, you can’t be expected to know all the differences between every ESP. Which is exactly why you should consider involving someone who knows the market and can help you select the vendors to include in your RFP. The last two enterprise RFPs we guided were won by vendors our clients wouldn’t have invited to participate in the RFP without our advice.

Think about that for a minute.

2. ESP pricing models are (almost) impossible to compare

ESP pricing models have become much more diverse and complex. ESPs have become very good at making side-by-side price comparisons between vendors almost impossible to do. 15 years ago an email marketer could basically compare CPM to CPM and determine which vendor had better pricing.

But over the last several years different categories of pricing have been added by these vendors. Things like data storage fees, subscriber fees, and technology platform operations. There’s no consistency between vendors, some charge for one thing, others for something else.

Avoid “whack-a-mole” pricing

What all of the new fees are specifically designed to do is allow the ESPs to present lower CPMs in the hope that a prospect’s focus will be solely on that number. Don’t believe me? In negotiations we’ve conducted on behalf of our clients we’ve seen vendors react to our request to lower one fee by raising the CPM. We call that “whack-a-mole” pricing.

In reality, the CPM listed in most pricing proposals today is only a partial CPM. Your actual CPM is your annual email volume divided by your total annual fees. We’ve solved the price comparison problem by creating a Common Pricing Template which forces the vendors to put pricing into our format for side-by-side comparisons of various pricing proposals.

If you wait to understand various pricing models until you’ve asked for pricing proposals in your RFP, you’re too late. The ability to make accurate comparisons will be hindered by a lack of understanding how each vendor arrived at its final cost.

Not fully understanding pricing models can be particularly painful if you end up selecting one of the ESPs that require upfront payment for your email program each year. Yes, you read that correctly. Nothing like paying a seven-figure amount before you’ve even started to migrate off your old vendor (and while you are still paying for the old vendor’s services!).

Wouldn’t you have liked to know that you had to pay in advance before you made your choice? I’m pretty sure your CFO would find that information useful!

3. You (marketing) and your IT team might have very different ideas about what the ideal ESP looks like

We have seen this scenario time and again in our work with our clients. And it’s not just a division between marketing and IT. There’s also the campaign production team, who also has its own ideas on what the ideal solution looks like.

This can lead to vigorous disagreements about the choice of vendor, and entire departments unhappy with the final selection.

Knowing what’s important to each department in advance can save you much grief during the RFP process and after the final selection has been made. Some vendor solutions can bridge gaps between teams better than others. Depending on who is making the decision at your company, the list of vendors you include can change dramatically.

Here’s a list of each group’s general priorities from our experience in managing email RFPs:

Marketing VPs and Marketing Directors priorities

- Huge emphasis on the stability/reliability of the platform

- Interested in the availability of value-added services like analytics and creative

- Critical to use various sources of data in real-time before it gets stale

- Also focused on robust reporting and analytics capabilities

IT priorities

- Tend to focus on the ability of email vendors to play the data “where it lies” (as opposed to marketing who doesn’t care whether or not it needs to move around) and overall data security.

- This often takes the shape of an on-premise solution like Adobe, or a hybrid like MessageGears.

- Or they gravitate towards email relay solutions that offer easy connections and extensive APIs like SparkPost and SendGrid, which typically don’t come with marketer-friendly UI’s. Have a look at the best SendGrid alternatives here, most of them have easy-to-use interfaces for marketers.

Campaign Production priorities

- Top priorities include how intuitive and usable the platform itself is.

- Ability to do everything they need to do without involving IT or the ESPs services team.

- Speed of the platform in performing campaign production operations

Pro tip: It’s an exceedingly good idea to make sure your campaign production team supports your choice of vendor. They’re the ones who will be using it on a daily basis and aren’t necessarily going to learn all the ins and outs of a platform they don’t like.

Conclusion: Shine a light on your Selection Blind Spots

You may have plenty of Blind Spots, things you don’t know you don’t know. But you can get help to make sure things go smoothly in your RFP.

For all of the reasons we’ve outlined – the vast differences between ESPs, the complexity of pricing models, and the differing requirements of your internal stakeholders–it makes a lot of sense to bring in help before starting your own ESP RFP.

Find a selection partner that brings a deep understanding of the pluses and minuses of the various vendors to ensure that you invite the vendors best suited to address your unique requirements and get a great deal.